It was introduced by Satoshi Nakamoto in the 2008 Bitcoin white paper, but the technology itself was conceived long before then. PoW was the first consensus algorithm to surface and is still the dominant one. Most major cryptocurrencies use this as their consensus algorithm, a method for securing the cryptocurrency’s ledger. It is a mechanism for preventing double-spends. It requires miners to mine blocks to validate transactions. PoW is one of the most common algorithms in cryptocurrency. We will elaborate on mineable and non-mineable crypto currencies in part three. Mining is also responsible for introducing new coins into the existing circulating supply and is one of the key elements that allow cryptocurrencies to work as a peer-to-peer decentralised network, without the need for a third party central authority.īitcoin is the most popular and well-established example of a mineable cryptocurrency, but you must note that not all cryptocurrencies are mineable. To put it simply, the process of validating a block in return for the block reward is called mining.Ĭryptocurrency mining is the process in which transactions between users are verified and added to the blockchain public ledger. You still communicate with nodes that aren’t implementing those rules, but you filter out some of the information they pass on to you.Ī perfect example of a soft fork is that of Segregated Witness (SegWit) fork, which occurred shortly after the Bitcoin/Bitcoin Cash split. However, doing so doesn’t automatically disconnect you from the network. If you want to only accept blocks below a certain size, you just need to reject bigger ones. Though there’s a limit on how big a block can be, there isn’t a limit on how small it can be. In a soft fork, you typically see the addition of a new rule that doesn’t clash with the older rules.įor example, a block size decrease can be implemented by soft-forking. Soft ForkĪ soft fork is a backward-compatible upgrade, soft fork allows upgraded nodes to continue communicating with the non-upgraded ones.

This is why we can still see the first block on the Bitcoin blockchain.Ī hard fork is basically a permanent divergence from a blockchain’s latest version, leading to a separation of the blockchain, as some nodes no longer meet consensus, and two different versions of the network are run separately. A blockchain is essentially a chain made out of blocks of data that work as a digital ledger in which each new block is only valid after the previous one has been confirmed by the network validators.ĭata on the blockchain can be traced all the way back to the first-ever transaction on the network. To understand what a hard fork is, it’s essential to first understand blockchain technology. One well-known example would be Bitcoin and Bitcoin Cash.įorks may be initiated by developers or members of a crypto community who grow dissatisfied with functionalities offered by existing blockchain implementations. It can result in a new cryptocurrency being created.

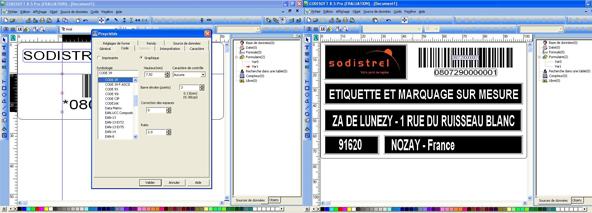

#Logiciel edition etiquette code barre gratuity update#

Hard ForkĪ hard fork is a radical update to the blockchain that can make previously unvalidated blocks valid or previously validated blocks invalid.Ī hard fork requires all nodes or users to upgrade to the latest version of the protocol software. In part two, we go through seven key crypto technical terms you need to know. SINGAPORE - In the first part of Don't skip crypto basics before you invest we covered elementary, but technical jargon related to cryptocurrency. Key crypto-related technical terms you need to know.

0 kommentar(er)

0 kommentar(er)